Spotlight On: Underwriting

In insurance, an underwriter evaluates and decides how much coverage a policyholder should receive, while evaluating risk (how likely they are to make a claim) and determining whether to insure the policyholder. Sometimes, the mind of an underwriter can seem like a mysterious place. But don’t worry! We asked one of our most senior underwriters some questions you might have asked yourself before.

1: What are the 3 most common questions you get asked by agents?

Limiting this to 3 questions is very difficult but I would say the most common topics we get are:

A) COVERAGE QUESTIONS like what coverage is there for my college student; how much or what is Covered in a storage unit and what coverage is provided by the Service Line Endorsement. There is limited property coverage for college students and in storage units. Service Line provides coverage for sewer/water pipes that service the property and also some other odds and ends.

B) Why did the rate go up on this policy or why has the dwelling amount been increased? Usually, the answer is a general rate increase or possibly a recent claims surcharge. Coverage is generally changed due to a recent inspection of the property or an underwriting review of the risk.

C) Can I write this risk? Is it eligible for coverage with TPC? The answer is usually YES or NO or more information is needed. Agents prefer to ask a UW rather than look it up in our Guidelines.

2: How has the underwriting process evolved since you started at TPC?

This is night and day really. I first started working at TPC over 25 years ago in Jan. 1996. Back then we received paper new business applications every day and the policies we worked on were in folders that we requested daily from the file room in the basement of the 210 building. Everything was manual and notes were made on paper and put in those policy folders. All correspondence to the agents was handwritten and diaries maintained in a pend-o-flex folder in our desks. LOL. One thing that hasn’t changed much is that agents can still call and talk to an Underwriter which is uncommon in the 2020s. This is one of the things that sets TPC apart from other personal lines companies.

3: What has been your favorite technological advancement in the Underwriting world?

What helps you the most? As much as I hear people complain about THE KEY…this is a wonderful system and helps make our jobs a lot easier. There is no comparison from 25 years ago at TPC when we used PICK and over 40 years since I started in the Insurance Industry. I can remember my first insurance job in 1977 having to wait in line behind 2 or 3 other associates to use one of the first computers to check the status of an account. Customers might be waiting on the phone for 10 minutes or more. Not good…..

4: What do you wish more agents understood about your Underwriting decisions?

It’s business not personal. I think the biggest thing in 2021 is all the data that we have available to us to help with making our decisions and how to convey and explain that info to our agents. Sometimes it’s almost an overload of info but underwriting still boils down to common sense and using available information correctly. Underwriters have to be smart and know insurance but good communication skills are equally important because you have to explain yourself to agency employees with varying levels of experience and knowledge. An underwriter has to know his/her audience and it’s a big challenge of the job. I am a people person and enjoy that part of the job the most. It’s always fun to get an agent on the phone with a combative attitude and by the end of the call getting them to be totally on board with your decision…or at least understanding of why you had to make it.

5: What is the most common issue you find when assessing different risks?

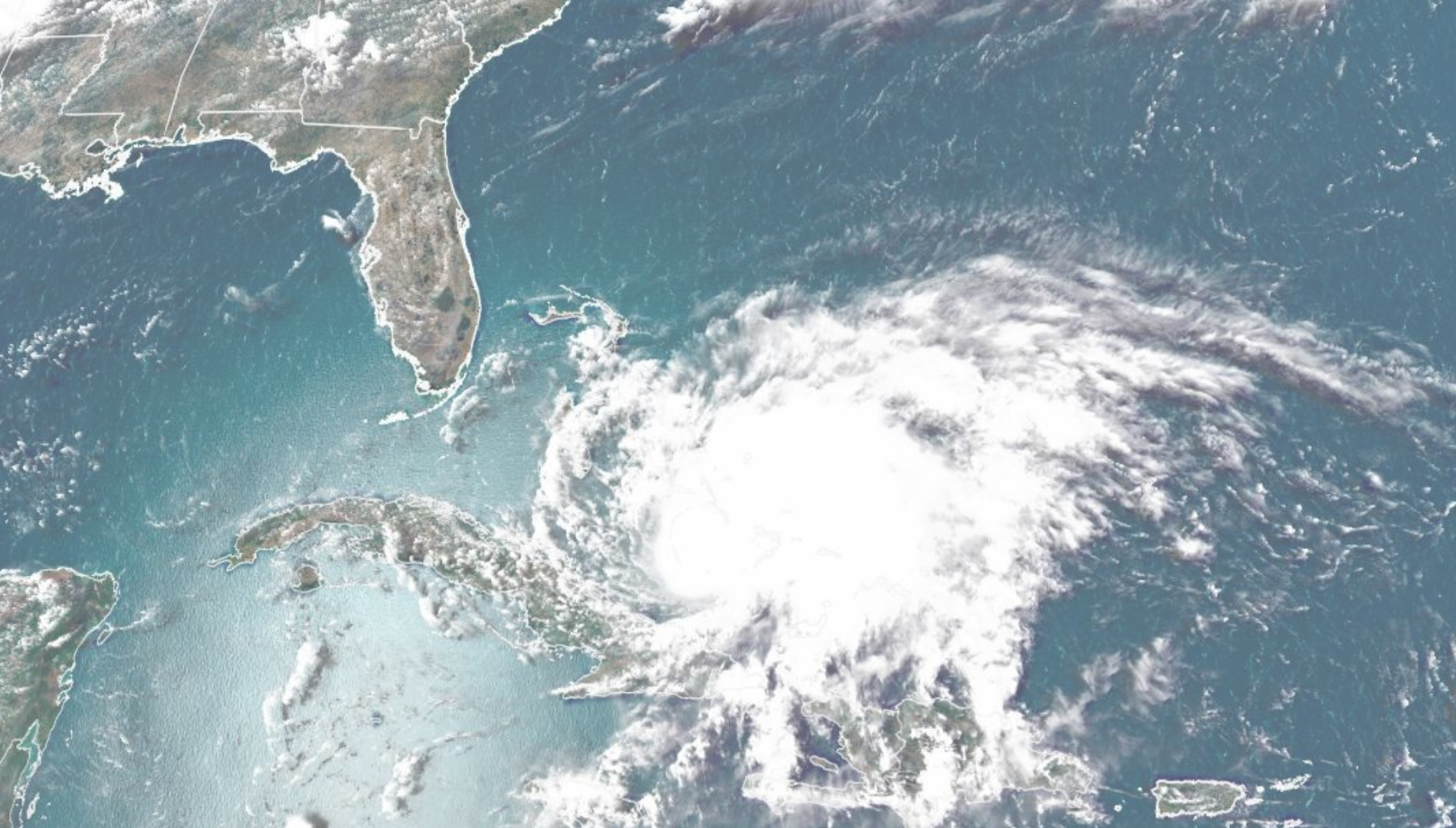

Probably the biggest concerns today are getting a proper premium for the risk (dwelling amount/Cov. A) and the current condition of the roof. One of the major property concerns in the 2000s is roof aging and the failure of many customers to replace worn-out roofs due to the economy. All homeowners know that replacing a shingled roof or sometimes even a flat roof can be the most expensive thing as a property owner. Many people just wait until their roof is worn out and hope for a severe windstorm to damage the roof and they then hope their insurance company will pay to replace it. As Underwriters, we have to get a good handle on the age/condition of the roof at the time of new business. Many new home buyers shortcut the home inspection process and don’t really know how old their roof is or the condition. TPC now has Cape Analytics which is drone technology that can get us aerial photos to show roof conditions within the past 3-4 months on most properties. Of course, we also use the on-the-ground new business inspection to help us with our evaluation. Detecting major roof concerns at new business is important to avoiding big claims down the road. The other big issue is Insurance to Value (ITV) and getting proper premiums for our exposure. This is done at new business and also during renewal reviews which are done every 4 years and sometimes in between if the policy comes across our UW path for review. Not getting adequate Coverage A on our risks results in inadequate premiums which adversely affects our TPC profitability.

6: What is your favorite part about TPC?

As a college history minor and long-time history buff, I obviously love the historic nature of working here at TPC. I worked at TPC from 1996-2004 and left for a decade but the thing that brought me back in 2015 was the people. The associates that I work with on a daily basis are just the best and are not only my co-workers but my friends. TPC has a nice mix of young, middle-aged, and senior associates. As one of the latter, I am happy that my experience and knowledge are still valued and respected. I am also blessed to be working for an incredible management team in UW. These guys are intelligent, wise, very kind, and understanding. They even have a sense of humor. Everyone is treated as an individual and as I previously mentioned….it feels good to be respected and valued. The company expects us to work hard and we do…but they also understand the need for personal life and outside interests. This is truly a company where we are treated as people and not an employee number.

Underwriting home insurance is all about understanding the details of the home, like the year it was built and the materials used to build it. Personal factors could also play a role, such as if the homeowner smokes or not. And homes in regions prone to hurricanes or flooding usually see much higher premiums due to the increased risk of providing insurance in these places. Every person who signs up for an insurance policy represents a different level of risk for the insurance provider. Underwriting is the art of finding the risk that any given policy represents for the insurers. While there are some judgment calls in underwriting, the company has strict guidelines and statistical methods for determining the risk on individual policies.

The Key Takeaways:

- Insurance underwriters assign risk to policies.

- Underwriters use statistical analysis software to help them determine risk.

- If the risk is too high, the underwriter can deny the policy.